🔍 Company Overview

RateGain Travel Technologies Ltd is a global leader in distribution technology and the largest AI-powered Software-as-a-Service (SaaS) provider in India’s travel and hospitality sector.

The company offers solutions across multiple verticals, including:

Hotels

Airlines

Online Travel Agencies (OTAs)

Meta-search platforms

Tour package providers

Car rentals

Cruises and ferries

With 3,200+ customers and 700+ partners in over 100 countries, RateGain drives revenue through better customer acquisition, retention, and increased wallet share. It processes vast volumes of electronic transactions and travel intent data, empowering commercial teams with predictive insights.

Founded in 2004, RateGain works with 26 of the top 30 hotel chains, 25 of the top 30 OTAs, 4 of the top 5 airlines, and 16 Fortune Global 500 companies.

📊 Key Financial Metrics (as of April 23, 2025)

Market Capitalization: ₹5,551 crore

Share Price: ₹470

Price-to-Earnings (P/E): 27.2

ROCE: 17.4%

ROE: 13.4%

Book Value: ₹132

Dividend Yield: 0%

📈 Technicals

Current Market Price: ₹458

52-Week High / Low: ₹859 / ₹413

47.6% below 52W high | 9% above 52W low

All-Time High / Low: ₹922 / ₹235

Beta: 0.90 (Moderate volatility)

📉 Stock Performance: RTTL vs Nifty50

5-Year Holding Period Return (HPR): ~32%

1-Year Return: −36%

While the stock has struggled recently, strong fundamentals suggest potential for long-term recovery and growth.

HPR : Contrary to the traditional '“per annum” measurement of return this is not suffixed by any periodic term. This indicates the absolute / percentage return generated by the investment throughout the tenure of investment.

📐 Valuation Overview

P/E: 26.3x

Sector P/E: 27.9x

Nifty50 P/E: 21.7x

Nifty500 P/E: 23.9x

Price-to-Sales (P/S): ~5.8

The stock trades at a premium to Indian mid-cap tech peers but is still reasonably priced when compared to global SaaS companies.

📆 Quarterly Financials (FY2024–25)

Q3 FY25 (Dec 2024):

Revenue: ₹278.71 crore (↑10.6% YoY)

Net Profit: ₹56.54 crore (↑39.9% YoY)

OPM: 22.06%

Q2 FY25 (Sep 2024):

Revenue: ₹277.26 crore (↑18.1% YoY)

Net Profit: ₹52.21 crore (↑73.8% YoY)

OPM: 21.72%

Q1 FY25 (Jun 2024):

Revenue: ₹260.01 crore (↑21.2% YoY)

Net Profit: ₹45.38 crore (↑82.2% YoY)

OPM: 19.14%

💡 Margin expansion signals strong operational efficiency and product leverage.

📅 Annual Performance (FY2023–24)

Profit & Loss Statement

Revenue: ₹957.03 crore (↑69.4% YoY)

Net Profit: ₹145.39 crore (↑112.6% YoY)

Operating Profit Margin: 19.82%

EPS: ₹13.1

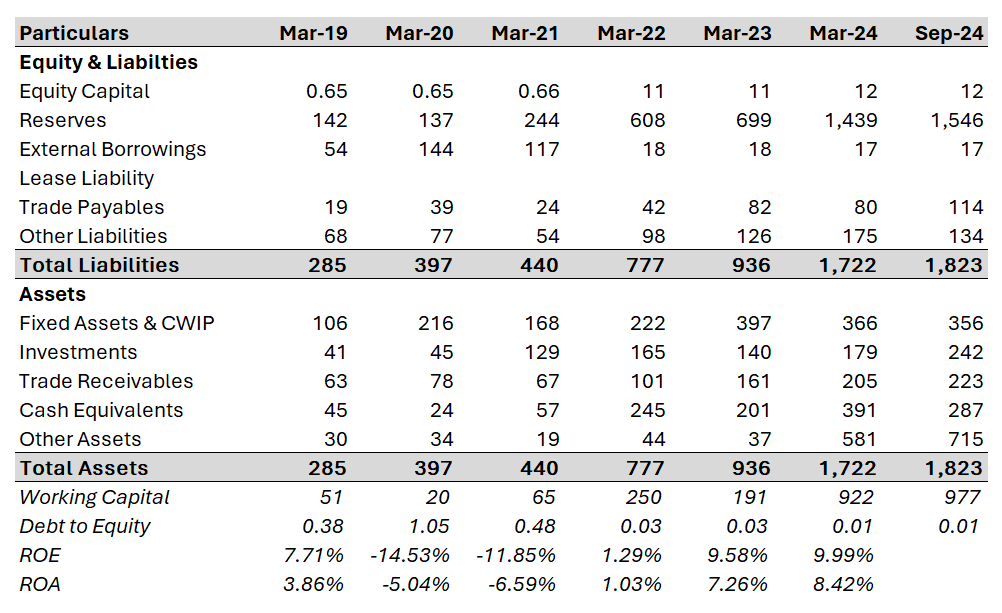

Balance Sheet

Cash Flow Statement

Shareholding Pattern

Promoter holding down 8.12% over 3 years (watch trend)

Institutional ownership increased significantly post-QIP

📊 Revenue & Asset Mix

💰 Strategic Capital Raise

In November 2023, RateGain raised ₹600 crore via a Qualified Institutional Placement (QIP), issuing 9.33 million shares at ₹643 per share.

The funds are earmarked for:

Strategic acquisitions

AI-based platform development

Customer acquisition tools

Recent acquisitions like Adara and MyHotelShop have strengthened its capabilities in data analytics and digital marketing.

✅ Strengths

75.2% profit CAGR over the last 5 years

Strong revenue and margin growth

Debt-free balance sheet → financial flexibility

Global reach with blue-chip client base

Data advantage enabling AI-driven decision making

⚠️ Risks & Weaknesses

Trades at 3.53x book value → expensive for some investors

Promoter holding has declined

Working capital days increased (70.7 → 199) → liquidity concern

Reliance on inorganic growth → integration risks

📌 Final Take

Despite short-term underperformance, RateGain stands out for its global presence, improving margins, and scalable tech model. If the travel sector continues its post-COVID rebound and RateGain executes well on integrations, it could offer significant upside for long-term investors.